Algorand trading bot

The Algorand trading bot is designed to simplify the process of crypto trading and offer individual traders an advantage over manual traders.

Set up bot

How to launch bot for Algorand?

Trading bot, after you connect it to your exchange, sells or buys coins in accordance with your pre-set instructions, signals generated by technical analysis and market conditions. So it trades and monitors the market for you but follows the strategy that you chose.

If you choose to trade using an ALGO cryptobot, you will be able to place multiple orders at certain market conditions and be able to do it faster than other traders thus gaining a competitive advantage.

Algorand trading bots have a number of advantages, including but not limited to: bots make purchases and sales based on market calculations and analytics, and they are unaffected by emotional swings or fatigue. They are also quicker than manually placing an order on the exchange.

Algorand (ALGO) trading

As of 01.04.2022, the coin is #28 in CoinMarketCap rating based on market capitalization of ${6,140,262,692}.

Now, with the current Algorand (ALGO) value of $0.92, you might be wondering why you should trade the Algorand (ALGO) coin.

Algorand is a proof-of-stake blockchain cryptocurrency protocol with a scalability-focused consensus mechanism that aims to overcome the blockchain trilemma.

The Algorand platform is similar to a major payment processor like Mastercard or Visa in that it is designed to process a large number of transactions quickly. Algorand is a direct competitor to Ethereum because it can host other cryptocurrencies and blockchain-based projects.

According to the forecast from Wallet Investor, Algorand (ALGO) coin’s price will continue to grow and has a high chance of reaching the level of $2 per coin by the mid of 2023. It has already attracted investor’s attention, so it might be a good idea to take a look at this currency.

VortexBlueBot strategies you can use to trade ALGO

DCA strategy

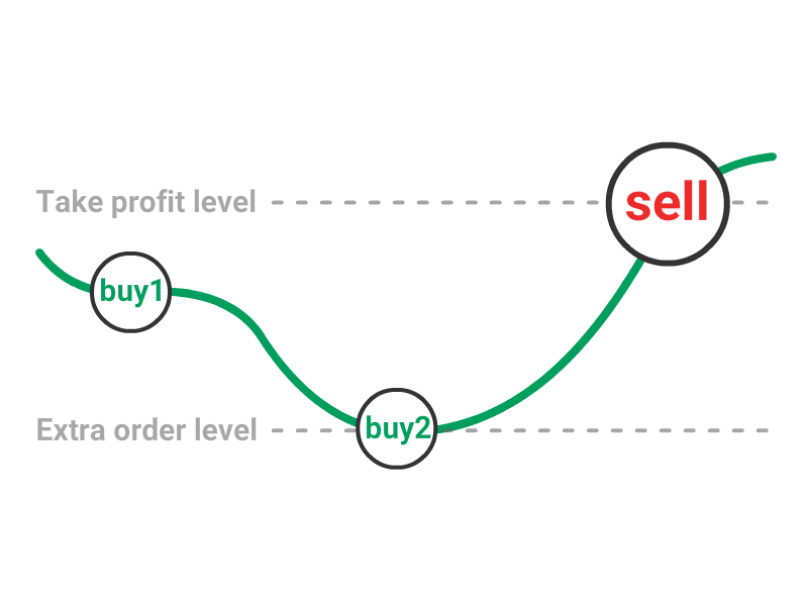

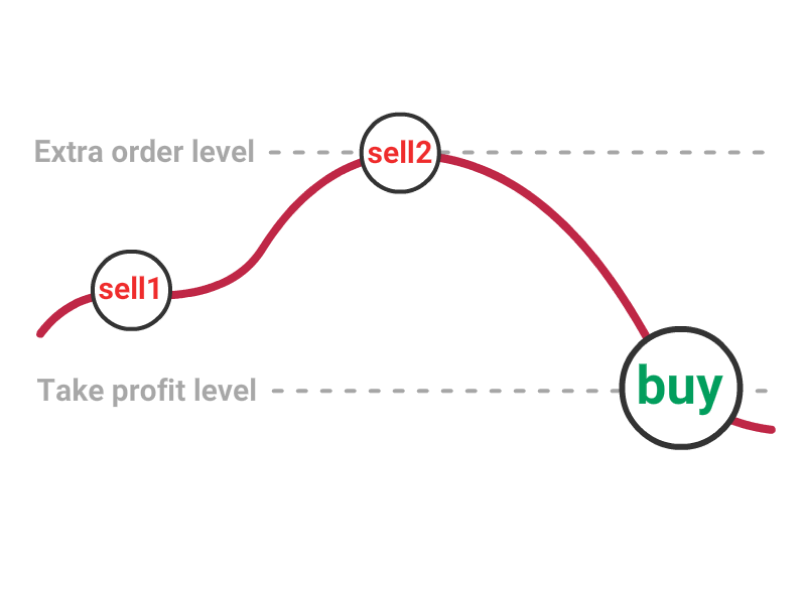

Dollar-cost averaging strategy is when a bot purchases (in long strategy) or sells (in short strategy) an asset in smaller increments rather than everything at once. It allows you to spread the risk in case the coin price goes opposite to your expectations, also it allows you to lower the average price of entry (for long strategy) or increase the average price of selling (in short strategy) thus allowing you to be able to get the same desired profit percentage at a smaller price rebound.

For a long strategy, DCA bot first buys cryptocurrency and later sells it at a higher price.

For the short trading bot, the first order would be a sell order, and the TP order would be a buy order at a lower price. The dollar-cost averaging bot places the first buy order and extra orders if the price goes in the opposite direction of the strategy chosen.

DCA Long strategy

DCA Short strategy

Grid strategy

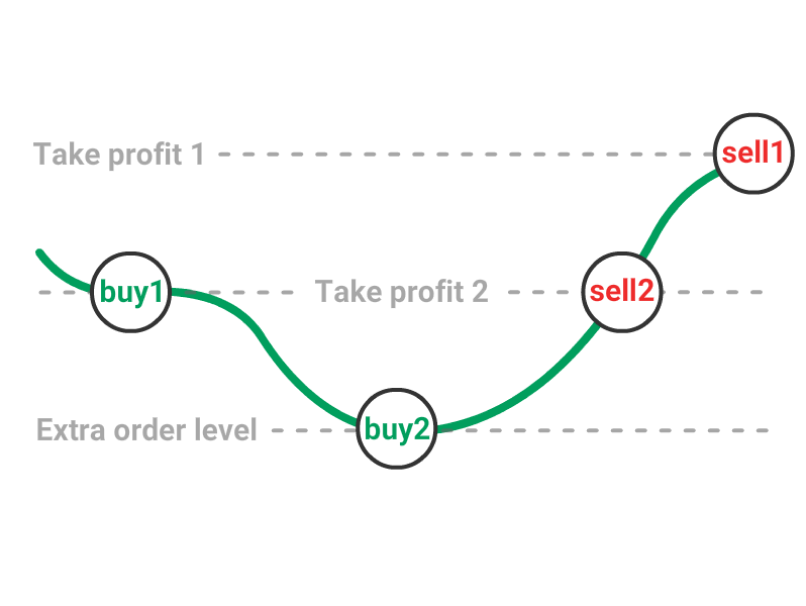

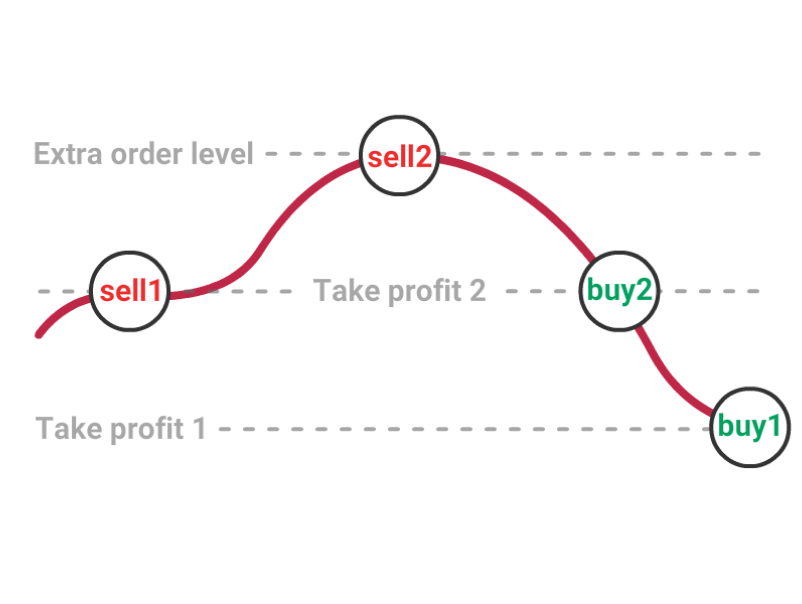

The GRID trading strategy, unlike most other trading strategies, works best in a market that is ranging sideways with no distinct direction. It profits from a market's price movement's highs and lows, and it works best when there is no discernible up or downtrend for a lengthy period of time. The grid strategy becomes increasingly profitable as the frequency and amplitude of price swings increase. Grid trading strategies, to put it another way, produce a grid-like formation by scheduling or setting up buy and sell orders in a predetermined price range.

Grid Long strategy

Grid Short strategy