DOT Bot for Crypto Trading

Polkadot trading bot is designed to simplify the process of cryptocurrency trading and offer individual traders an advantage over one another.

Set up bot

How to launch bot for Polkadot?

Obviously, starting something new is always difficult, especially when it comes to putting money into a product that is yet unknown.

That is why, at VortexBlueBot, we believe it is critical for you to test before you purchase. You can use our 3-day free trial of the Maximum package and see for yourself if trading via bots is for you.

Several benefits of Polkadot trading bots include, but are not limited to: DOT bots buy and sell based on market calculations and analytics, and they are unaffected by emotional swings and fatigue. Furthermore, they are faster than manually placing an order on exchange.

Polkadot (DOT) trading

As of writing (24.02.2022), Polkadot is #13th in Coinmarketcap rank according to market capitalization, Polkadot (DOT) is one of the most popular coins to trade, along with Bitcoin (BTC), Ethereum (ETH) and Binance Coin (BNB).

As of writing, the coin’s market capitalization is ${14,390,548,573}$.

Now, with the current Polkadot (DOT) value of $14.90, you might be wondering why you should trade Polkadot (DOT) coins.

In 2021, DOT saw a massive increase in price, which was equal to more than 300x, reaching more than $53 per coin. According to price predictions, we might see DOT double its price in 2022 up to $35 per coin, and continue to grow afterwards.

Polkadot is an example of a next-generation blockchain protocol that allows any sort of data or asset, not just tokens, to be transferred across blockchains.

Furthermore, interoperability protocols such as Polkadot may execute numerous transactions in parallel, eliminating the so-called bottleneck that occurs in conventional networks that process transactions one at a time.

Polkadot (DOT) exchanges

Since Polkadot (DOT) is one of the most popular coins on the market, it’s not hard to find an exchange where you can trade it.

Binance,

Coinbase.Pro,

HitBTC,

OKEx,

Huobi,

for example, all enable you to trade this coin. Simply open your PC or mobile, make an account, and you're ready to go.

VortexBlueBot strategies you can use to trade MATIC

DCA strategy

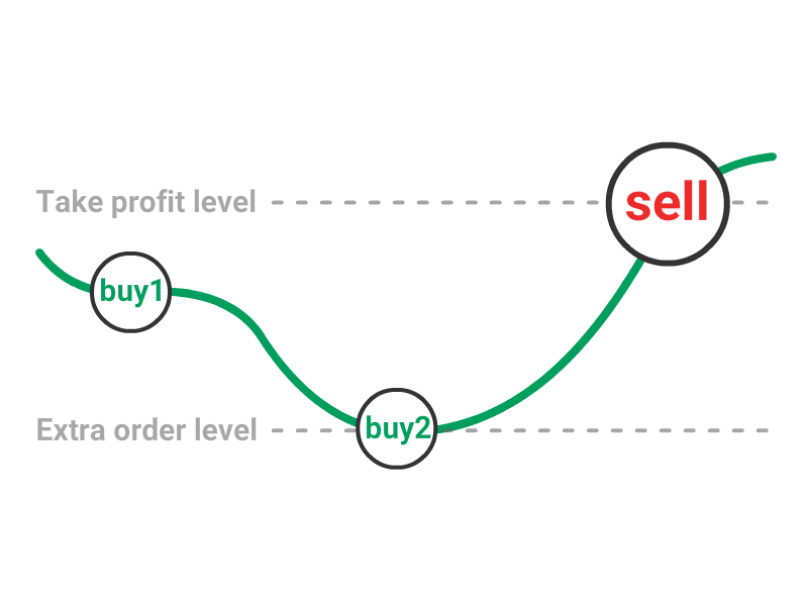

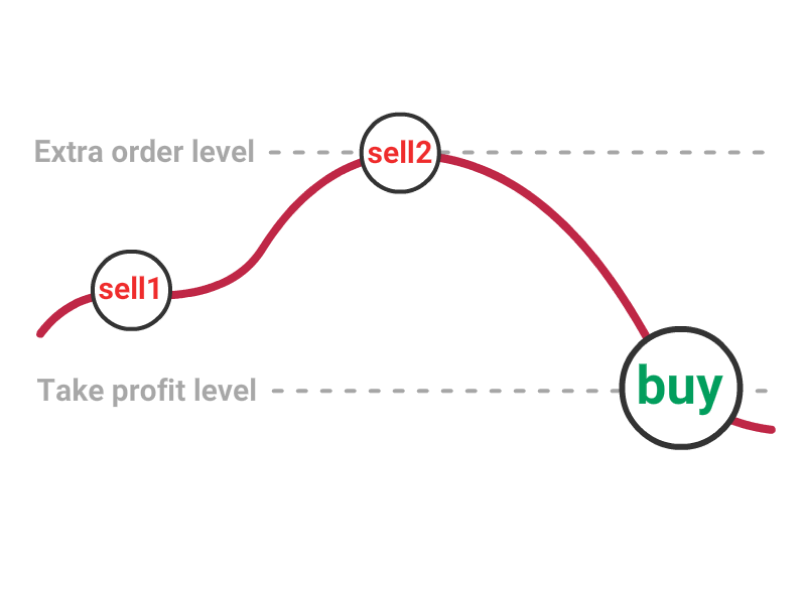

Dollar-cost averaging strategy is when a bot purchases (in long strategy) or sells (in short strategy) an asset in smaller increments rather than everything at once. It allows you to spread the risk in case the coin price goes opposite to your expectations, it allows you to lower the average price of entry (for long strategy) or increase the average price of selling (in short strategy) thus allowing you to be able to get the same desired profit percentage at a smaller price rebound.

For a long strategy, DCA bot first buys cryptocurrency and later sells it at a higher price.

For the short trading bot, the first order would be a sell order, and the TP order would be a buy order at a lower price. The dollar-cost averaging bot places the first buy order and extra orders if the price goes in the opposite direction of the strategy chosen.

DCA Long strategy

DCA Short strategy

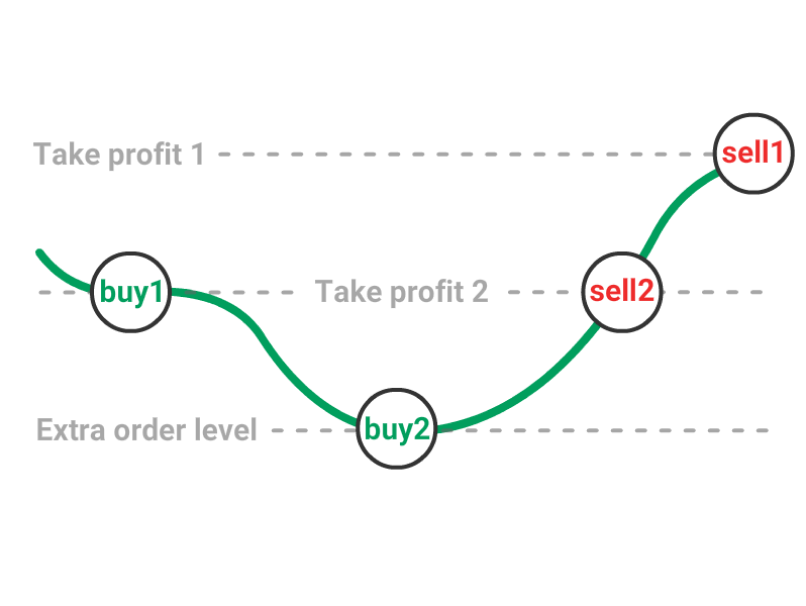

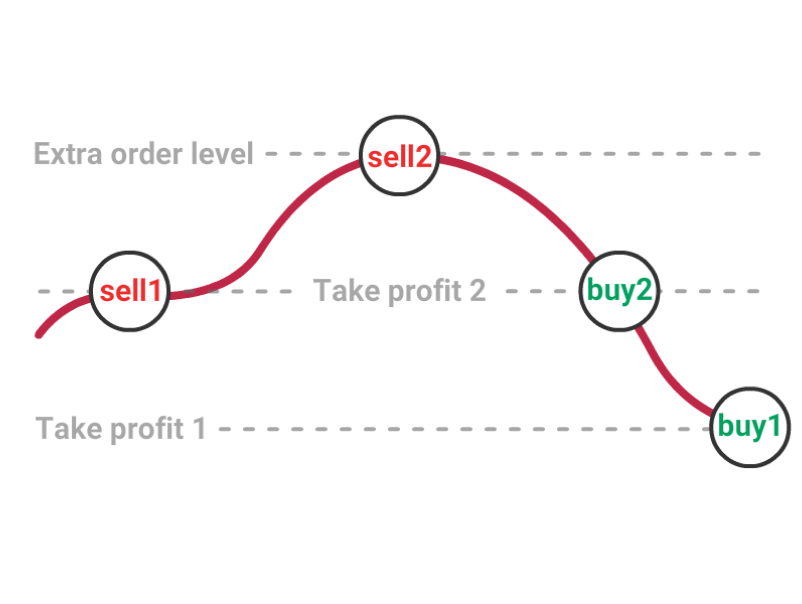

Grid strategy

The GRID trading strategy, unlike most other trading strategies, works best in a market that is ranging sideways with no distinct direction. It profits from a market's price movement's highs and lows, and it works best when there is no discernible up or downtrend for a lengthy period of time. The grid strategy becomes increasingly profitable as the frequency and amplitude of price swings increase. Grid trading strategies, to put it another way, produce a grid-like formation by scheduling or setting up buy and sell orders in a predetermined price range.

Grid Long strategy

Grid Short strategy