Ethereum Classic trading bot

Ethereum Classic bot is a piece of crypto trading software that automates the process of buying and selling ETC in accordance with a pre-programmed strategy. But what kind of trading strategy can that be?

Set up bot

How to launch bot for Ethereum Classic?

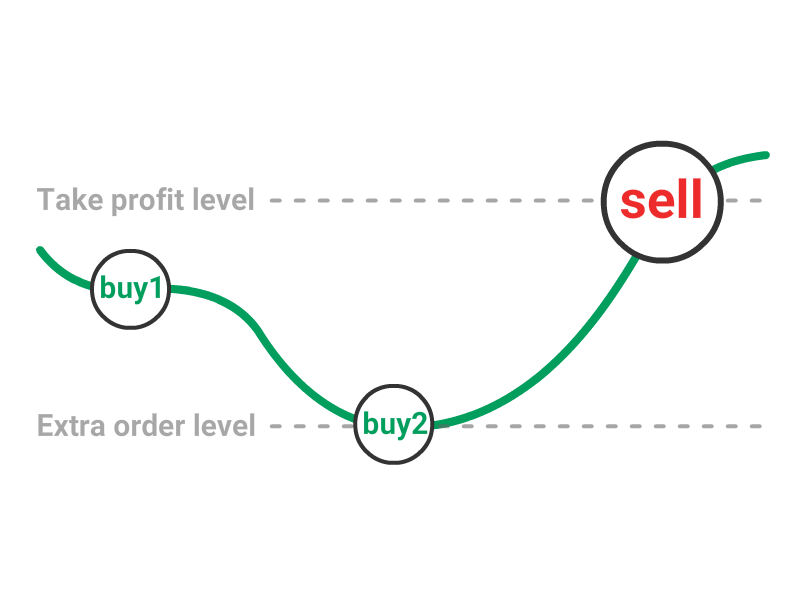

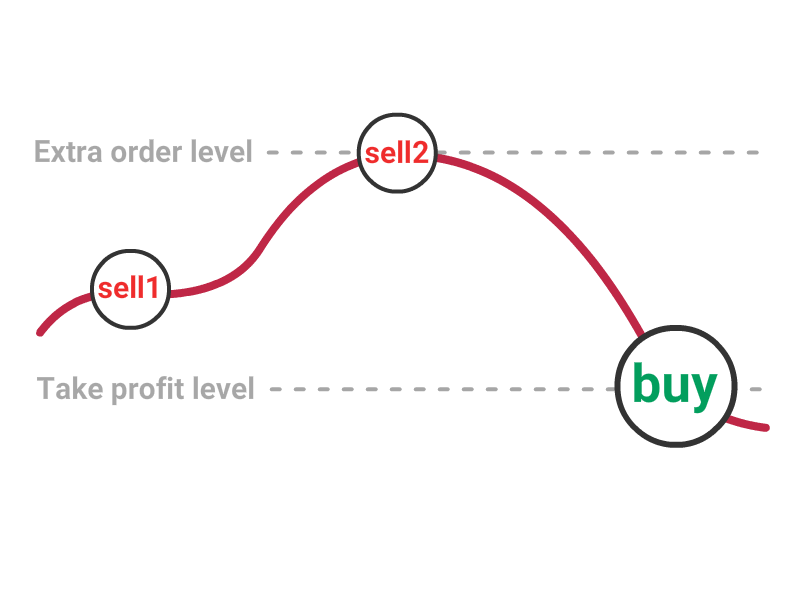

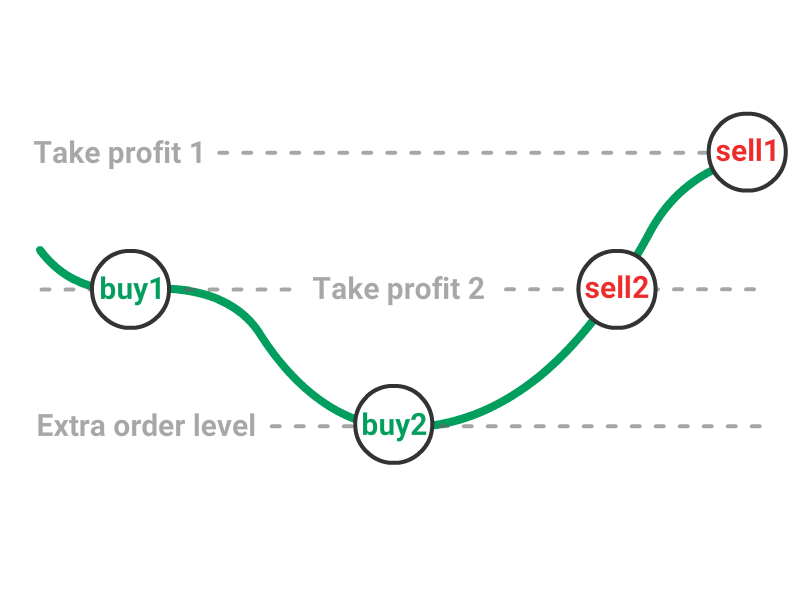

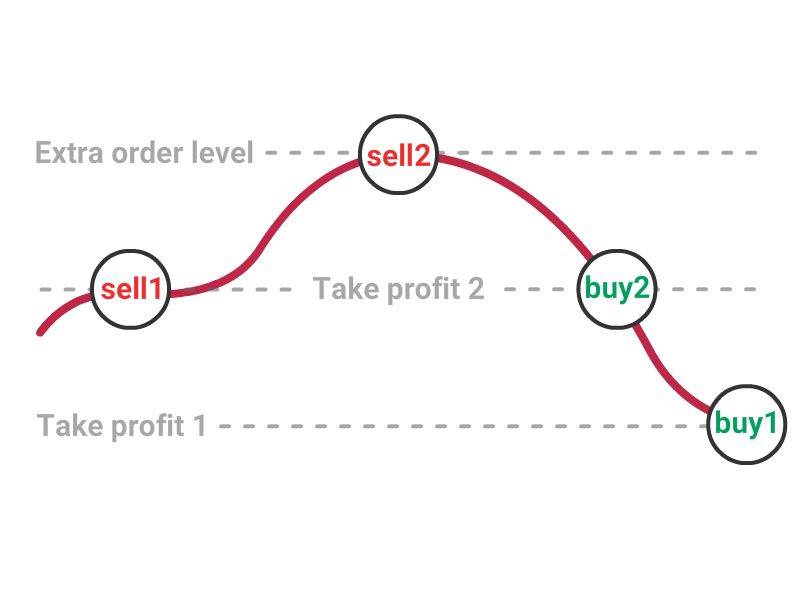

Say, you want to buy Ethereum Classic with a grid bot and you do so. If after some time the price of the coin goes into the opposite direction, the grid bot will place extra buy orders with a take-profit target for every separate deal.

Complicated? Read more on the strategy here, but it was just one example of what you can do with Ethereum Classic while using crypto bots.

Why Ethereum Classic bot?

If you’re an individual trader, there is a set of reasons why it makes sense to use automation for buying and selling Ethereum Classic.

First of all, it’s a great way to gain competitive advantage over other individual traders. Crypto market is still fresh and populated with human traders, not algos, as it happens to be in the traditional stock market, so bots do really speed you up.

Since you’re trading with an Ethereum Classic crypto bot, you can trade bigger volumes of the asset. How so? Just create as many pairs as you wish in accordance with your package.

And last but not least, crypto bots help you spare your emotions for something really important, for example, your family. There is no need to experiment with those roller coaster rides when the price of Ethereum Classic goes up and down, up and down - crypto trading bots will monitor the asset for you.

Ethereum Classic (ETC) trading

With its current price of $6.13, Ethereum Classic might strike you as an asset that is not worth investing in. However, as of writing, its market capitalization of more than $713 million puts the asset to the 24-th place of the CoinMarketCap ranking. Ethereum Classic’s 24-hour trading volume was as high as $539 million.

Over the past three years, the asset has seen highs and lows, just like any other crypto coin, trading for $0.452 on July, 25, 2016, and $47.77 on December 21, 2017.

Just like with any other cryptocoin, you might want to invest in ETC, to take advantage of this crypto asset’s volatility. On the other hand, beware the fraud because if something happens to your funds, you will hardly ever find someone to sue.

Ethereum Classic exchanges

Being the talk of the town in 2016, when the Ethereum network split in two separate blockchain, ETC is still one of the top-30 top runners in the world. It’s pretty liquid, and you can trade it on top of all the popular platforms such as HitBTC, Binance, Huobi, OKX, Bybit, Kraken, and FTX.

VortexBlueBot connects you to all of those exchanges, so you can even give a try to automation tools for free. Is your trading volume less than $3K/month, and you only need two bots? Run them as long as you like with no time limit on top of our platform!

VortexBlueBot strategies

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does VortexBlueBot work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.