Ethereum trading bot

Ethereum bot is an automated software that connects to an exchange and sells or buys ETH in accordance with your pre-set instructions, signals generated by technical analysis and market conditions.

Set up bot

How to launch bot for Ether?

Before diving deep into detail, let’s quickly deconstruct the term “Ethereum trading bot”.

First of all, you should know that there are two types of Ethereum out there. As the result of the DAO theft in 2016, Ethereum founders have forked the initial network. So now we have two different blockchains with two different cryptocoins. The forked network is called ETH Classic (ETC) whereas the most popular one is Ethereum (ETH).

On top of VortexBlueBot, depending on a bot type and an exchange, you can trade such pairs as Bitcoin/Ethereum (BTCETH), Tether/Ethereum Classic (USDTETC), Ethereum/Stellar (ETHXLM) and many more.

What is a trading bot, then? It is an automated software that connects to an exchange and sells or buys coins in accordance with your pre-set instructions, signals generated by technical analysis and market conditions.

That being said, your personal Ethereum trading bot is an automated software that connects to the exchange of your choice and trades Ether for the coin of your preference in accordance with your pre-set instructions, signals generated by your technical analysis tools and conditions in the markets that you trade.

The same rules apply to the Ethereum Classic (ETC) bot and all the other cryptocurrencies you want to trade with the help of the automated software. You can trade Ethereum Classic (ETC) on Binance, Huobi, OKX, HitBTC, Bybit, Kraken, and FTX.

Is there the right Ethereum bot?

There are many bot types out there, such as Grid bots, DCA bots, market maker bots and many more. The bot you want to use is defined by your needs. Just to give you an example, let’s take a look at the Ethereum arbitrage bot. A crypto arbitrage bot can be of two types. The first one is the market arbitrage bot that looks for price discrepancies within one exchange.

ETH market arbitrage bot

Let’s consider the example where your goal is to earn more Ether than you already have. How can your trading bot do that?

Normally, your bot starts with scanning markets to find opportunities for arbitrage. But let’s say your bot has found some price discrepancies in these pairs: LEOETH, EOSLEO and ETHEOS.

Say, you’ve got 1 ETH on your Bitfinex account.

First, your bot will buy LEOs with your ETH. Considering that one LEO costs 0.007 Ethers, you will be able to buy 142 LEOs for one ETH.

Now, you’ve got 142 LEO tokens, and your bot will sell them to buy EOS. One LEO token is worth 0.54 EOS coins, which means you’ve just purchased 76 EOS coins.

And finally, it’s time to buy back your ETH. One EOS costs 0.016 ETH, and now you have slightly more ETH on your accounts, namely, 1,2 ETH.

ETH exchange arbitrage bot

The second arbitrage bot type is the bot that makes profits on market inefficiencies between different exchanges. Oftentimes, it simply sells high on one exchange and buys lower on the other executing 2 orders at the same time. For example, as of writing this, on top of Bitfinex, you can sell one Bitcoin for $6,476 and buy it for $6,456 on top of HitBTC. Normally, your arbitrage bot also considers exchange fees, so that you could make profits.

VortexBlueBot strategies

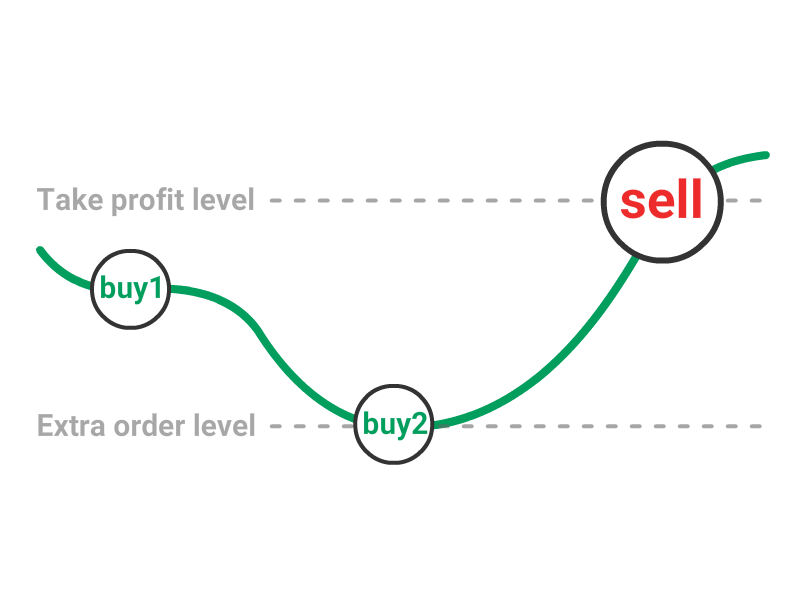

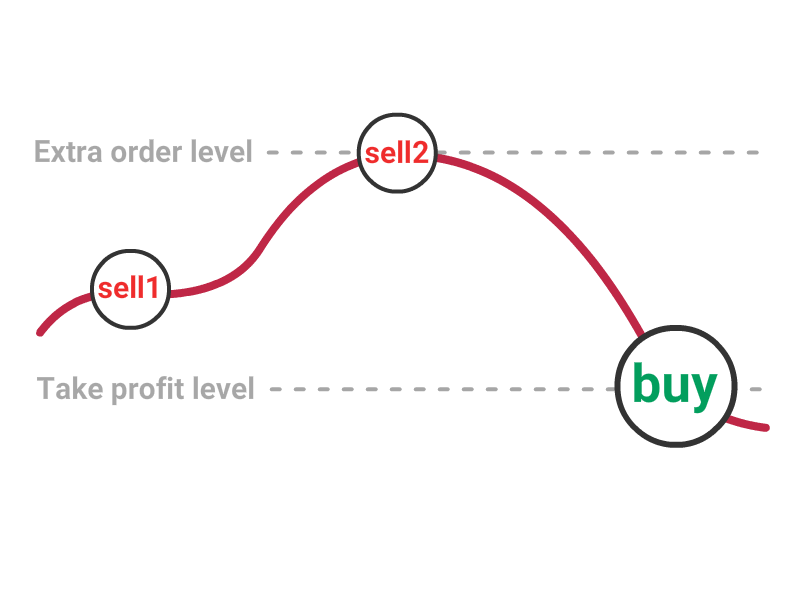

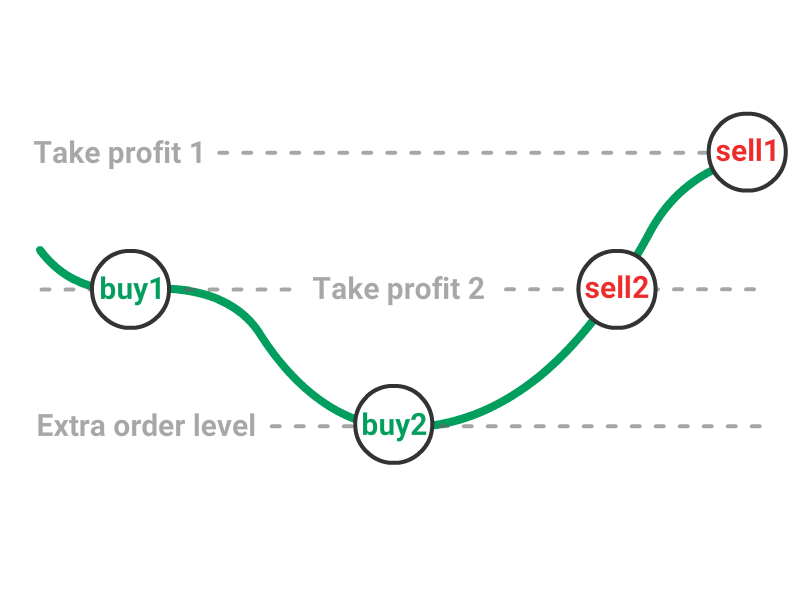

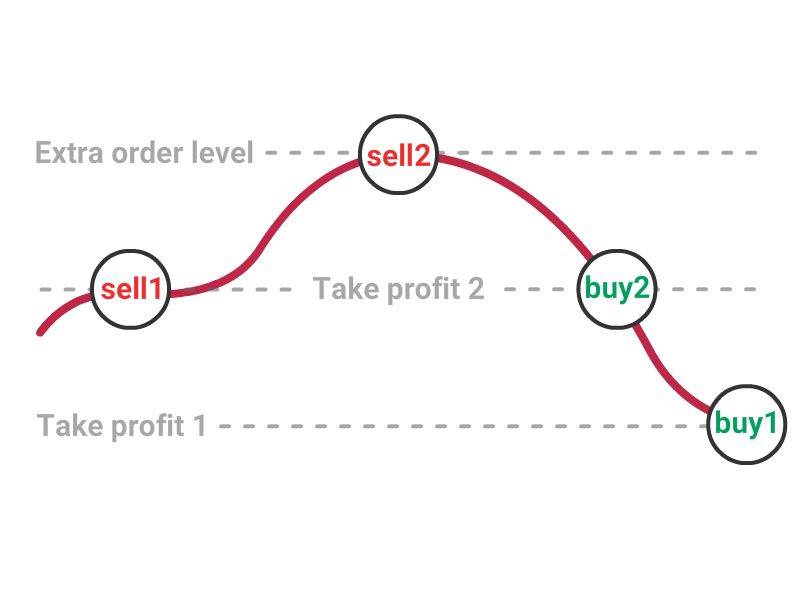

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does VortexBlueBot work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.