FTX Token trading bot

The FTX Token trading bot is designed to make cryptocurrency trading easier and to provide individual traders an advantage over manual traders.

Set up bot

How to launch bot for FTX Token?

Certainly, beginning something new is challenging, especially when it comes to investing funds in an unknown product.

That is why we believe it is important for you to try VortexBlueBot bots before you buy a subscription plan. Use our 3-day free trial of the Maximum package to see if trading with bots is efficient for you.

After connecting to your exchange, the trading bot sells or buys coins based on your pre-set instructions, technical analysis signals, and market situation. Thus it trades and analyzes the market for you, but only according to your strategy.

In case you choose to start using an FTX token cryptobot to trade, you'll be able to place several orders at different market conditions and do it faster than other traders thus gaining a competitive advantage.

FTX Token (FTT) trading

As of 31.03.2022, FTX Token is #27th in Coinmarketcap rank according to market capitalization. FTX Token (FTT) is one of the most popular coins to trade, along with Cardano (ADA), Polygon (Matic) and Chainlink (LINK).

The coin’s market capitalization is ${6,853,037,114}. With the current FTX Token (FTT) value of $49.87, you might be wondering why you should trade the FTT, what’s so special about it?

FTT is used as a utility token for the FTX cryptocurrency exchange. It can be used as collateral against futures positions or to decrease trading fees on the exchange. It can also be staked in order to earn interest and win NFTs.

According to CoinMarketCap, FTX token’s price has increased from $1.8 in August, 2019 to almost $50 in March, 2022, and it has all the chances to grow further. According to a forecast by Wallet Investor, we might witness FTX token to reach a level of $80 by the fourth quarter of 2023.

FTX Token trading bots have a number of advantages, including but not limited to: bots make purchases and sales based on market calculations and statistics, and they are untouched by emotional swings or fatigue. They are also faster than manually making an order on the exchange, and they are available 24 hours a day, seven days a week.

FTX token exchanges

Since FTX Token (FTT) is a decently popular coin on the market, it’s not hard to find an exchange where you can trade it. However, you must take into account the fact that FTX Token cannot be bought on major US exchanges. like Coinbase, for instance.

Binance,

HitBTC,

OKEx,

Coinbase.Pro,

Bybit

and Huobi, for example, allow you to trade this coin. Simply open your PC or mobile, make an account, and you're good to go.

VortexBlueBot strategies for trading FTX Token

DCA strategy

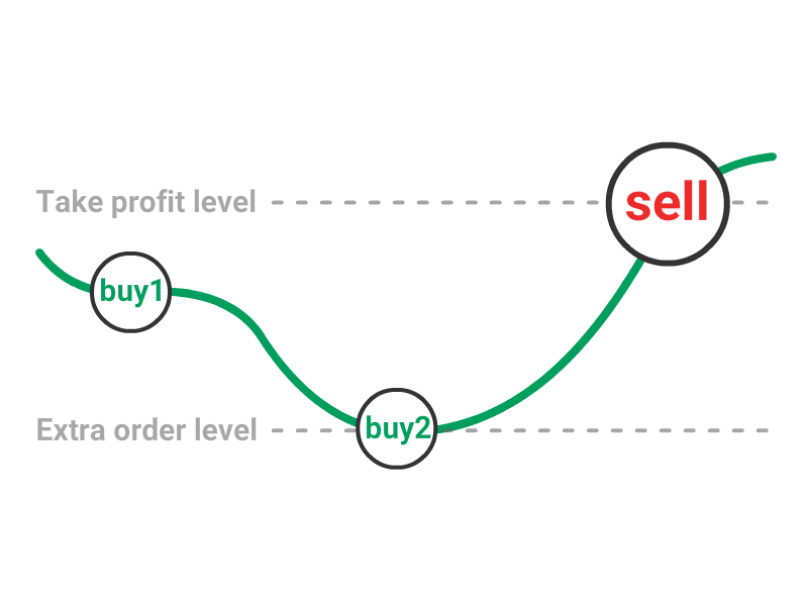

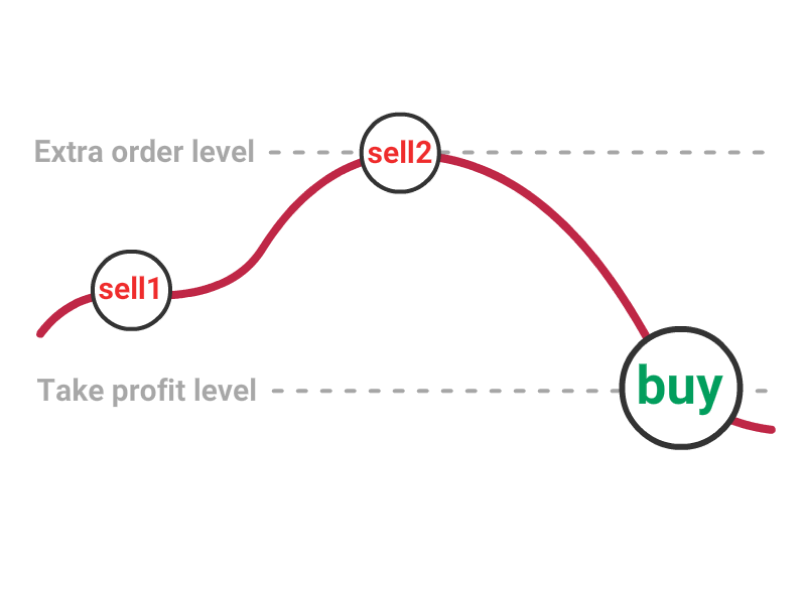

Dollar-cost averaging strategy is when a bot purchases (in long strategy) or sells (in short strategy) an asset in smaller increments rather than everything at once. It allows you to spread the risk in case the coin price goes opposite to your expectations, also it allows you to lower the average price of entry (for long strategy) or increase the average price of selling (in short strategy) thus allowing you to be able to get the same desired profit percentage at a smaller price rebound.

For a long strategy, DCA bot first buys cryptocurrency and later sells it at a higher price.

For the short trading bot, the first order would be a sell order, and the TP order would be a buy order at a lower price. The dollar-cost averaging bot places the first buy order and extra orders if the price goes in the opposite direction of the strategy chosen.

DCA Long strategy

DCA Short strategy

Grid strategy

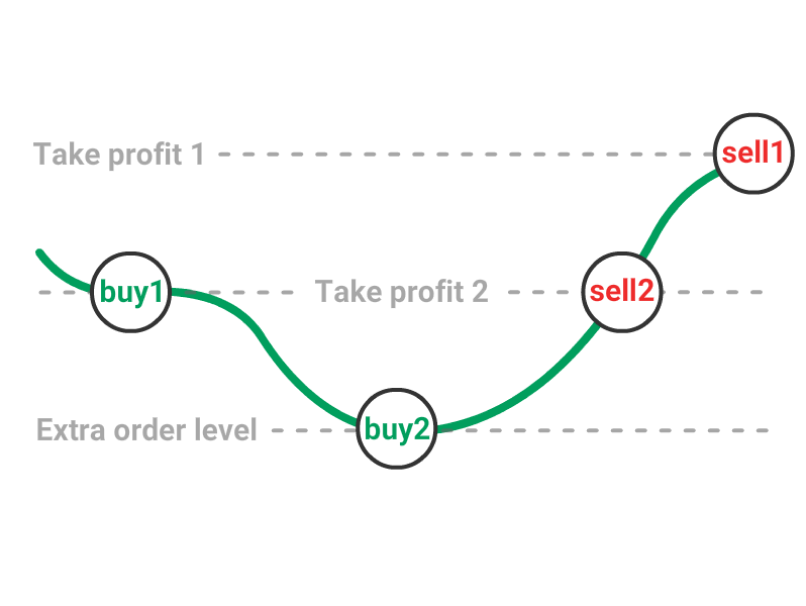

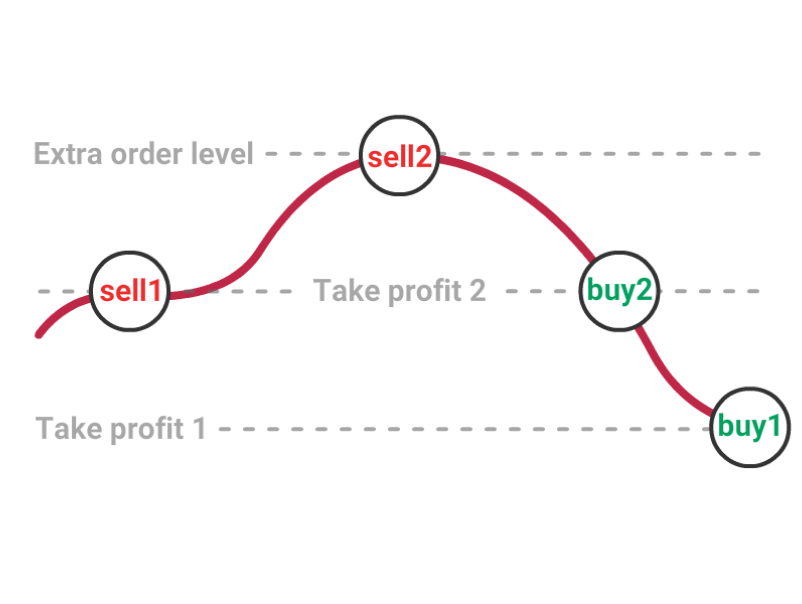

The GRID trading strategy, unlike most other trading strategies, works best in a market that is ranging sideways with no distinct direction. It profits from a market's price movement's highs and lows, and it works best when there is no discernible up or downtrend for a lengthy period of time. The grid strategy becomes increasingly profitable as the frequency and amplitude of price swings increase. Grid trading strategies, to put it another way, produce a grid-like formation by scheduling or setting up buy and sell orders in a predetermined price range.

Grid Long strategy

Grid Short strategy