NEO trading bot

NEO bot is a crypto trading bot built to automate the process of trading, open and close several deals simultaneously, make the most out of fluctuations 24/7 and give you a competitive advantage over other traders.

Set up bot

How to launch bot for NEO?

There are several reasons why you might want to go and trade NEO. Maybe you believe in a heavily-regulated smart economy of the next-gen Internet. Maybe you think that the digitalization of real and financial assets is the future of our society, or, rather, you see how the trend on the chart is good for this particular token.

Being as volatile as any other crypto, NEO, however, has survived the market crisis of 2020 and the downfall of the crypto niche after the hype of 2017. As of writing, it costs $11.62 but was trading in the range of $9 to $12 during July 2020, which sounds like a good fit if you lean toward swing trading and automated crypto trading.

Trading NEO with a crypto bot might be a good idea if you want to get rid of unnecessary levels of stress, outperform other traders, get access to bigger trading volume, utilize market opportunities 24/7 and, ultimately, automate what can be automated.

NEO trading

As in the case with many other altcoins, the price of the asset was following the general market fluctuations.

In autumn 2017, NEO cost $10, however it sky-rocketed in January 2018 and reached $150. In the next few years, just like the prices of the majority of the alts, the price of NEO was slowly going down, following the overall trend in the crypto market.

In March 2020 when the things went nuclear, the asset witnessed a 50% decrease in the value of the asset, yet, in June it bounced back to $12.90 and, as of writing, in the bullish trend again.

The market capitalization of the asset to date is $913,682,044 USD, the 24H volume is $223,579,736 USD; the all-time high we’ve witnessed is $196.85, which happened on Jan 15, 2018; and the all-time low is $0.072287 USD as of Oct 21, 2016.

NEO trading platforms

So, is NEO easy to buy? Well, the asset is very liquid, and you can trade it on top of major crypto trading exchanges.

For instance, with Bitfinex, you can buy and sell it for USD, EUR, JPY, GBP, BTC, ETH. On top of Binance, it’s possible to trade NEO for USDT, USDC, BUSD, BNB, ETH and BTC. Talking about HitBTC, you can trade it for BTC, ETH, USDt, EURS, DAI, TUSD, EOS, BCH.

Do you want to try a NEO bot for free and connect to major trading venues you’ve got an account with? Try VortexBlueBot’s bots and let them work for you on top of prominent crypto exchanges, including HitBTC, Binance, Huobi, OKEx, Bybit, Kraken, and FTX

VortexBlueBot strategies

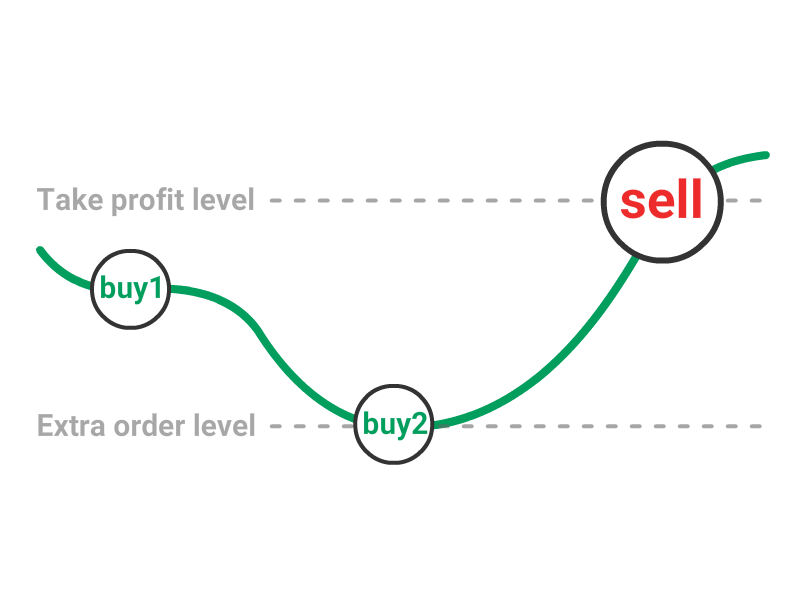

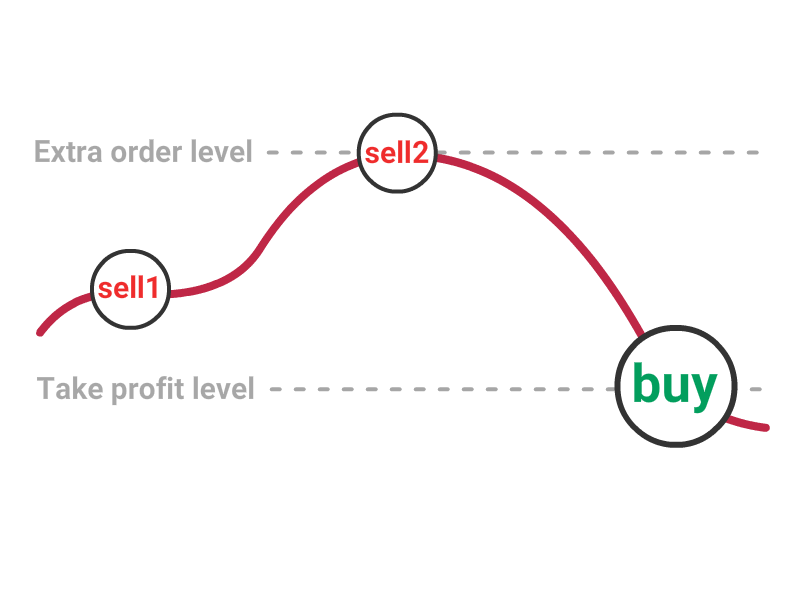

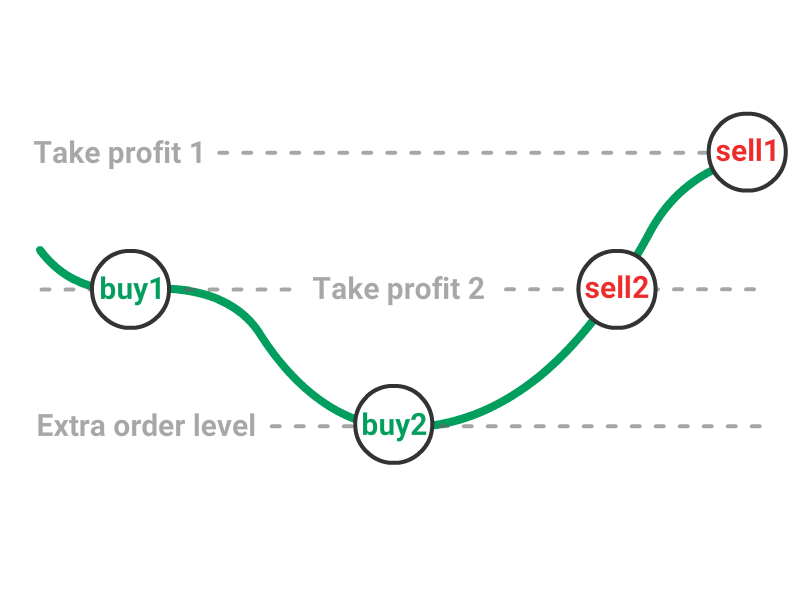

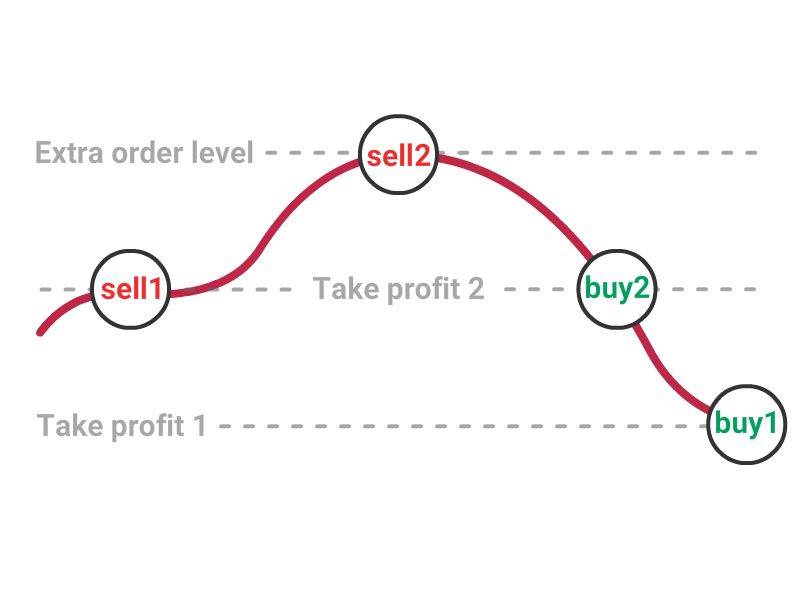

DCA strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Grid strategy

There are 2 main aspects when it comes to the trading fees on HitBTC: trading fee tiers and the “maker-taker” system. Trading fee tiers is a rewarding program for traders with high trading volumes. That means the more you trade the lower your fees are. You can check out the full list of tiers.

Frequently Asked Questions

What is trading bot?

Crypto trading bot is a software program, which automatically executes trades according to a predetermined strategy. Basically, the trading bot places buy and sell orders on your behalf on the crypto exchange.

How does VortexBlueBot work?

Once your trading bot is set up and ready to buy and sell cryptocurrencies, it will open a deal either immediately or after a signal from technical indicators is received, depending on the filters set. For the first order crypto bot buys the amount of base currency indicated in the settings by the user.

What settings are the best?

There is no "best strategy" for automated cryptocurrency trading, it is not a money making machine. You may use one of the templates to start and adjust them according to your needs after. To get the best results you should conduct your own research and make your strategy, according to your trading volume, market situation, chosen cryptocurrency pair and etc.